What’s going on, everyone? Episode No. 4! I'm getting into this. I'm starting to enjoy it. So, last week, I did a bonus episode. I did two episodes last week. Don’t know if I'll have time to do that this week, but I'm working on several episodes. So, I'm excited about the content that I'll be able to put out in the near future.

Today, I thought I would do an episode about sacrifice. What are you willing to sacrifice in order to be financially free? And don’t get me wrong. I ask that question still on my own journey towards financial freedom.

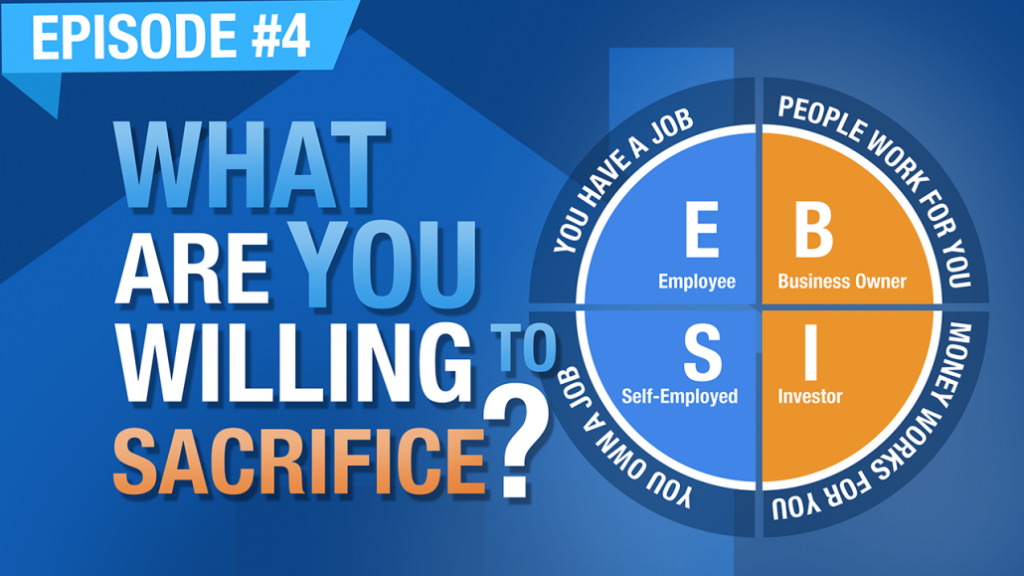

So, I haven’t gotten there yet myself, but it’s in sight. I have a plan that I feel confident will get me there. And the reason I don’t feel I'm there already is because in the reading of what I think is Robert Kiyosaki’s second book, The Cashflow Quadrant, he mentions the four quadrants that a person receives their income from.

And the cashflow quadrant is basically a circle, which is divided into four regions, and the upper left hand corner is [E] for employee, which is where most people get their income from, and that’s the quadrant that my wife’s income is derived from. Then the lower left side of the quadrant, is [S], for self-employed or small business, and that’s where I get my income from. I'm in the [S] quadrant. Back at the top, on the right side, is [B], for business, which Robert Kiyosaki describes that as more than 500 employees, or a business that will continue to run even if you're not there for a prolonged period of time. Below that, the lower right corner, is [I] for investor.

And so, I operate out of three of the four quadrants, with my wife being in the [E], me being in the [S], and she and I together in the [I] through our rental properties and other investments that we have. But we’re not in the [B] quadrant. My businesses, none of them are larger enough. There are no 500 employees in any of my companies. If I weren't there for some period of time, and when I started, especially my IT company, it would not last a day if I wasn't there.

And then as I read books like The 4-Hour Workweek, and Traction, and other books that teach you, basically, how to create a real business that doesn't rely upon you, I was able to put systems and procedures in place that backed off some of that responsibility from my shoulders.

So, now, yes, the business can operate for some period of time without me, but it’s not years. It’s probably not even months. It’s weeks at best. And so, I don’t consider myself to operate in the [B] quadrant, and based on Robert Kiyosaki’s definition, I don’t operate in that quadrant. Even with my investments, they call rental properties ‘passive income’, but they’re only passive to an extent. You do have to do some things to keep the money coming in, and to keep everything from falling apart. And so, they’re not completely passive. And so, until I get to that point where I have enough money coming in from activities that require nothing of me, I don’t consider myself to be financially free. But I do have things in works that will get me there.

So, going back to what I was asking before, what are you willing to sacrifice in order to become financially free? And I ask this because I had to make some sacrifices to get involved in real-estate investing.

Prior to 2015, I was an avid sports fan, and I was a guy who had the NFL Sunday ticket, and I would watch several games on Sunday. I would record several games, and I would be watching those games Monday, Tuesday, Wednesday, and Thursday of that week. This was before there was regular Thursday night football, and I would be watching the Monday night game without trying to find out who won on the games that I recorded. So, I would usually record the Monday night game, and watch it later, and football went throughout my week. Basketball, professional basketball, especially when it got past the all-star break, and when the playoffs come around, I was there every game. College basketball, most games. College football, most games, I pretty much liked every sport with the exception of baseball and hockey. At one point, I was in three different NFL fantasy sports leagues at the same time.

Very confusing to keep up with things, and I watched a lot of television. Sci-fi TV shows and movies, crime dramas, action, a lot of different shows, always watching television. Even when I was working, I would usually have a television on in the background. My excuse was that I am not really paying attention to it. I'm still getting my work done. It’s just something on in the background to keep me entertained. But it took up a lot of time watching television all the time. When I was in my car, I would usually be listening to music, or political talk radio.

When I decided I was going to become serious about real-estate, I cut all of that out of my life, pretty much cold turkey. I quit watching sports entirely. For three years, the only sports I watched were the Super Bowl. The first year, it was just because I was invited to someone’s house to watch it. But other than that, I cut out sports entirely, including all the playoffs. Didn't watch those either. And an amazing thing happened, I kind of lost interest in it. It was like the desire to watch sports just faded away over a short period of time. I became uninterested to the point where when I came across a game, or I would hear somebody saying “hey, such and such game is on”, like Duke and Carolina, or something like that, I was like “huh, well”, I wasn't really all that interested in watching it, which was something that’s unheard off for the former version of myself. I would have planned my entire day, if not a week, around making sure that I was going to be able to watch that game, but I gave that up. Why? It was a sacrifice I was willing to make for real-estate.

Likewise, with regard to television, I watched everything you could think of. We've got like three DVR’s in our household, so there’s plenty of capacity to record all sorts of programs, but I cut it out. The only thing I continued watching were the few programs that my wife and I watched together. So, there’s like that two hour window between 8 and 10 when we’re both in bed, we would watch some program together. I continued to do that because that’s time spent with my wife, laughing or joking about something ridiculous that we’re watching on television.

Other than that, I cut television out of my life, and then music. I stopped listening to music entirely. I completely cut out political talk radio type programs. I realized, ultimately, that it wasn't doing me any good to be up on the latest politics that wasn't pushing my financial freedom goals down the line. So, I killed that as well.

I replaced all of these things that were sucking time out of my day and my week, with reading books on real estate and on business and on mindset, most of all, listening to podcasts. When I'm in my car, that’s what I'm listening to; someone’s podcast. And I hope my podcast can become that for someone else. I would soak up information from podcasts. When I'm at home, I would be listening to books, and again, whenever I say read books, I probably mean listen to. Audible was on all the time in my car, a lot of time at home, when I'm cutting the grass, when I'm working around the house, when I'm cooking dinner, or anything, I'm probably consuming something about business and real estate. Those things that weren't productive to my financial freedom goals, I got rid of them.

So, that’s why I ask; what sacrifices are you willing to make in order to put a plan in a system in place that you can follow that will, ultimately, lead you to financial freedom? Are there things in your life that, while enjoyable, are not really the best productive use of your time? What can you get rid of in your day that doesn't take you away from friends and family, but still allows you to clear time on your schedule for education, for enlightenment, evaluation of what you’re doing now that you can potentially do better in order to become financially free sooner?

For me, it was to get rid of sports, politics, music, and entertainment, right up until the point where it would have also caused me to lose friends and time with family. And that does not mean everyone has a right to be in your life. If there are people, even family and friends, who are detrimental, or even just not supportive of you trying to achieve financial freedom, they don’t need to be in your life.

Limit your exposure to negative influences and move on to better things. I have a very dear friend who lamented the fact that I was no longer able to debate the latest political happenings because I wasn't following it anymore. But I replaced that time with education on real-estate. I wouldn't be able to have this podcast right now if I didn't educate myself over the prior four years on real-estate investing. Everything I'm speaking to you about, and will speak to you about, I learned over that period of time, and I continue to learn now, because of the fact that I replaced non-productive, time-suck pastimes that filled my week with productive time, to educate myself on something that I was passionate about, and that is financial freedom through real-estate investing, specifically rental properties; being a landlord. And that is what brought about the [… and Landlord] podcast. So, what are you willing to sacrifice?

I would submit to you that if you spend any time listening to music, in my opinion, you’re wasting your time. Unless your line of work is somehow in the music business, listening to music isn't doing anything to enlighten you. It’s not doing anything to educate you on finances, or business, or real-estate, or anything.

Watching TV, I would submit to you that Dancing With the Stars is not going to lead you to financial freedom. The Bachelor is not going to make any money for you. Anything with hip-hop, or wives of some profession, or city, in the title, is not going to teach you how to manage finances. Whatever reality show, whatever TV show you spend your time watching, and there are lots of out there that I would really love to watch, they’re not going to make any money for you. I make an exception for a few shows that my wife and I like together because that’s time that we have together to laugh and joke about something. With that exception, and keeping it limited, I don’t watch a whole lot of television. I gave it up, even though there are countless shows on TV that I would love to watch. I think, right now, we’re probably in the golden age of television. There has never been a better time to be entertained on television, or at the movies. But is it going to get you to financial freedom? I would say no.

What are you willing to sacrifice? That is a question that needs to be answered, because it will take sacrifice in order to get to financial freedom. And it’s not just the sacrifice of the things that spend time, it’s also a sacrifice of the things that spend money. Do you spend $6 every morning on a cup of coffee? If you do, I would say you’re wasting money. That could be used to save towards a down-payment on a rental property. There are lots of activities that we undertake every day that we don’t realize how much money they spend.

What I did related to finances, is I bought a program called Quicken, and I started tracking all of my finances in Quicken. It told me, after a very short period of time, what I spent my money on. I could tell you, to the penny, what I spent on for beer, for pizza, and clothing and dry-cleaning. All the different things that I spent my money on, I would enter it into Quicken, and I would categorize it all. Thankfully, because of the fact that I don’t transact in cash very often, it was easy for me to categorize and lay out all of my transactions in Quicken.

And it becomes shocking to see where your money goes, how much I spend at Chick-fil-A, or Bojangles. It was shocking when I looked at it, and realized one year that I spent almost $750 that year at Bojangles, and even more at Chick-fil-A. That’s ridiculous. It was $2000 in fast food I could have put towards a rental property. So, I immediately changed my habits. I sacrificed that apparent desire for fast food, and I stopped going to Bojangles, to the point where I didn't remember the last time I went, because of the fact that I was able to see that it was wasting money going out to eat fast food all the time. And not just there, other places I looked at how much we spent at Olive Garden, and Red Lobster, and Outback. Not just the chain restaurants, but when we would go to places that are better, it was a lot of money being wasted. So, we decided to sacrifice on our eating out budget, and to start cooking more at home. I learned how to cook, because I previously did not, and between my wife and my self, with both of us cooking, it created a lot more leftovers, and it saved a lot of money.

So, look through your schedule. Look through your finances. Put some method in place of tracking your spending. See where you’re wasting not just time, but also money. Re-deploy that time towards educating yourself on business, on real-estate, on finances. Change your spending habits so that you have as much money as possible to invest for your future. Save money so that you can invest that money, so that money then starts working for you. You cannot be financially free only working for money. You have to have money also working for you, and you’re not going to get there if your time is spent on Dancing With the Stars. Don’t let me pick on that. I think I have that in my head because Brandon Turner often uses that as an example on the Biggerpockets Podcast, and I listen to that all the time.

Regardless of what it is that’s consuming your time that’s non-productive, you need to re-evaluate, and re-position, so that you can be financially free. So, ask yourself what are you willing to sacrifice, and then do it, so that you can eventually become financially free.

What Are You Willing To Sacrifice? What are the steps to Financial Freedom?... Yes, it is a buzzword, but it is also a most precious thing to be sought-after with all your effort. And are you really giving it ALL your effort? Are you even giving it SOME effort? Most people think they are, when they really are NOT - or worse, they don't even think about it at all. Which is sad, because you're not likely to stumble into financial freedom. Sure, I buy a lottery ticket here and there, but that's not my plan for financial freedom... That's just me bowing to the 2nd best advertising line in the history of ads... "You Can't Win If You Don't Play". FYI, the best is "What Happens In Vegas Stays In Vegas"; and if you care to know, the worst is "Six Is Greater Than One".

But back to my point... A lottery ticket should not be anywhere in your plan to achieve financial freedom; and if you're going to do so, it will take SACRIFICE. In this episode of the [... and Landlord] Podcast, I relate my personal sacrifices made as part of my plan to achieve financial freedom. My sacrifices included: Entertainment (Sports / TV / Movies); Fast Food & Dining Out - each of these things consumed too much of my time and/or money, so they had to be figuratively crossed-off my daily to-do list, thus largely eliminated from my day-to-day routine. But that was just half of what needed to change. The other side was to replace these time wasters with productivity and learning, plus saving money for investing so that my money could begin working for me.

Instead of watching Football and Basketball, I began listening to Podcasts and reading / listening to books on Business, Real Estate, Mindset, etc...