Ep. #5 - Expanding On The Cashflow Quadrant - Diversify Your Income For Wealth & Financial Freedom

Show Episode Transcript

Opening / Quote:

As I've progressed to overcome challenges in business, real estate, and even as a husband and a father, I've come across certain quotes that I found in some way inspirational, or that helped to focus my thoughts on an area of my personality and habits where there was just room for improvement. So, I'd like to begin sharing some of these with you. One that I feel relates well to this episode is most often attributed to Gustavus F. Swift, "Don't let the best you have done so far be the standard for the rest of your life."

Intro:

Husband, Father, Entrepreneur, Realtor, a long list of other titles and descriptions... and Landlord. Welcome to the [... and Landlord] Podcast with me, Jonathan Taylor Smith, also known as J.T. - following a roadmap to Financial Freedom through Residential Rental Real Estate. Welcome to the [... and Landlord] Podcast...

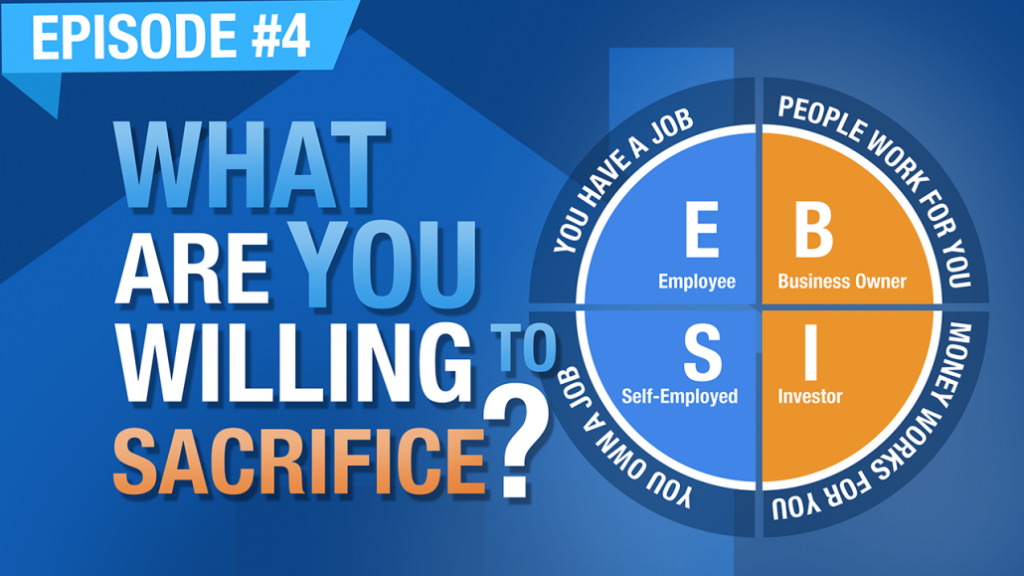

Welcome back, episode number five. So, the previous episode was basically about sacrifice. What are you willing to sacrifice in order to achieve financial freedom? At the start of that episode however I mentioned the second book from Robert Kiyosaki, called the Cashflow Quadrant. My opinion is that it's the best of his books, but you really do need to read the first one, Rich Dad Poor Dad, prior to reading the Cashflow Quadrant. The Cashflow Quadrant is all about how you make your money as it relates to achieving wealth and financial freedom.

And as I mentioned in that episode, it's a circle divided into four regions or quadrants. And the upper left is [E], for Employee, which is where most people get their income. Below that, the lower left is for [S], which is Small Business, or Self-Employed, which is where I get my income. My wife gets her income from the [E] Quadrant, I get most of mine from the [S] Quadrant. Above that, back on the right at the top is [B], for Business. And in his book, he describes it as a business that has more than 500 employees. But as you go further into it, you learn that it really relates to any business that has been systematized such that it runs largely independently of the owner. And I am seriously striving towards that in my businesses. Below that, the lower right corner is [I] for Investor. And that's where we get the other portion of our income, from rental properties and other investments that we have.

For most people, being in the [E] Quadrant, the goal is to spread yourself into those other quadrants until you're entirely out of the [E] Quadrant and you are making all of your money from the [S], [B], and [I] Quadrants. And even better, from the [B] and [I] Quadrants. This relates to the quote that I led with, "Don't let the best you have done so far be the standard for the rest of your life."

If you're currently getting all of your income from the [E] Quadrant, nothing wrong with that. You can get rich in the [E] Quadrant. There are people that have extremely high levels of income from the [E] Quadrant. But it's harder to become wealthy if operating solely in that quadrant. You really need to diversify your income, because when you're in the [E] Quadrant, you're working for someone else. Your destiny is not in your own hands. You need to protect yourself in case the company goes out of business, or they downsize, or you're let go for some reason.

When you're in the [E] Quadrant, you are among the most highly taxed individuals, with the fewest deductions and shelters to protect yourself and limit your tax liability, which is why it is extremely difficult to become wealthy when operating only out of the [E] Quadrant. So, what are you going to do to spread your wings, to move into those other quadrants? Because by doing so, you truly do have the opportunity to change the standard for the rest of your life, to make what you do in the future better than what you've done up to this point.

And that should be taken in no way disparaging as to what you've accomplished up to this point in your life. Remember, I started my first company in 1996. I was self-employed starting from 2002. But I didn't get into real estate until 2015. By anyone's measure, I was successful for that entire period of time. Anyone looking at me would have said, "Hey, he's a successful business man." - I knew that I could achieve more. And so I orchestrated things so that I could move into another area of income, that being investment property, rental properties, and the [I] Quadrant.

And so from that point, with my wife operating in the [E] Quadrant and me being in the [S] Quadrant, we both worked to expand over into the [I] Quadrant with rental property investments and other investments. So, now we're operating in three of the four Cashflow Quadrants. But yet I still know that I have more within me, so I am working to systematize my businesses so that they will truly run without me, putting people in place with the knowledge, skills, and authority to run the businesses on my behalf so that they are viable businesses, not just for a day or a week without me at the helm, but for months, or if necessary, for years. That they will still be viable businesses that operate without me, that bring in cash-flow, that supports my needs financially. That will be financial freedom.

So, my goal is to get entirely into the [B] and [I] Quadrants. For now, I want to operate in all four quadrants. And you know that a table with four legs is far more stable than one with three, or two, or one. If you're only operating in the [E] Quadrant, you have a table with one leg. That's not stable. It's an entertaining circus act, but eventually you're going to fall. So, you need to move into those other Cashflow Quadrants. Add more legs to your table to make it more stable. And the easiest way of doing that is to get your finances set so that you can start buying assets, and investing in things that create cash-flow, that have an income component.

There are other investments that you can pursue, paper investments, stocks and bonds, mutual funds, ETF's. Those things have their place, but that's not what my podcast is about. And that's not what my passion is in. I love rental properties, and being a landlord. And even if you don't want to be a landlord, you can outsource that to a property manager. It's all about putting people, policies, procedures, in place that allow you to be able to get the most out of your day without everything being your responsibility, ultimately building your wealth in the process.

Then in addition to moving into the [I] Quadrant with some sort of investment that creates cash-flow, again, rental property is where I'm at, you need to start a business. Some kind of side hustle. There's so many things that you can do to make money online today. And then even still, lots of businesses that you can start that are in the real world, but can be advertised online. There are opportunities all around to move into the [S] Quadrant. And yes, you're not likely to get rich overnight. Your business isn't going to go live on Monday and you're rich by Friday. You're going to have to work at it. Remember, I started my first business in 1996. I didn't become self-employed until 2002.

So, it took me six years to get to the point where my business was making more money than I was on my day job, and I felt confident to be able to quit, which up to that point was the hardest thing that I have ever done, to quit a perfectly good job thinking that my business was going to be able to provide for me and my family from that moment forward. Scary stuff, but I did it.

So, you don't have to think that your business is going to transform your life overnight. It's going to take work. But what you're doing is you're setting that foothold in another Cashflow Quadrant. You're adding another leg to your table, making everything more stable. And eventually if you do get to that point where your business is making more money, and your time would be better spent on that business than working in the day job, then go ahead and quit the day job, because even though you're, again, removing a leg from the table, the [S] Quadrant leg is far more beneficial to you than the [E] Quadrant leg.

First of all, you are now in control of your own destiny. You're self employed, you have a job that you own. It's your job that you created for yourself, and you are in control of your own destiny. More important than that, as a self-employed individual, as a business owner, you have tax benefits, deductions, and shelters against taxes that can start building your wealth, because when you're in the [E] Quadrant, you earn money, you pay taxes on that money, and then you spend what's left over. But when you're in the [S] Quadrant and the [B] Quadrant, you earn money, you spend money, and you pay taxes on what's left over.

Did you catch the difference? In the [E] Quadrant you pay your taxes first, and then you spend what's left over. But in the [S] and the [B] Quadrants you spend the money first, tax free, and then you pay taxes on what's left over. Now, of course there are some limitations to that. You have certain rules and regulations you have to follow. But the general sense of it is that as a business owner you are expected to have certain expenses for your business. You have to keep your personal and your business finances separate, but to the greatest degree possible you put your expenses on your business. You spend the money before you pay tax on it, and then you pay tax on what's left over.

The difference is transformative for the creation of long term legacy wealth, because taxes are your number one expense in life. Nothing will take more of your money than taxes. And it's not just income taxes, but property taxes, sales tax, and all the fees and everything that you pay taxes on. You don't even realize many of the taxes that you pay. You don't realize how much of the price of something you buy, like a gallon of gas, is actually just taxes.

Taxes are your number one expense in life. And so by moving yourself from the [E] Quadrant to the [S], and then later to the [B] Quadrant, you are creating a wealth effect of tax savings. So, you keep your [E] Quadrant job for as long as you have to. But as quickly as possible you need to move into the other quadrants. And the easiest of the other quadrants to move into, from my experience, are the [S] and the [I] Quadrants. It doesn't take a lot of money to start a business on the side. And it takes far less than most people realize to buy investment property assets.

Like I've said before, you can get a bank to give you 80% of the money. My first rental property, it required less than $20,000 out of my pocket. And that may sound like a daunting figure to many, but there are many ways that you may not be thinking of that you can get $20,000 to buy an investment property. And there are techniques that you can use that might require zero out of your pocket. So, start looking for ways to move into the [S] and the [I] Quadrants. And if you have to keep your [E] Quadrant job while you do that, there's nothing wrong with that. As a matter of fact, there are some scenarios, like the case for my wife, where it makes perfect sense for her to stay in her [E] Quadrant job, especially with what we're doing in the other quadrants, because it won't take very long for her to get to a point where she can retire and will have an income from that job for the rest of her life.

So, why would you quit something like that prematurely, even if you have income from other sources? I quit my job because, well one it was excruciating, I was never cut out to be an employee. But I needed to free my time in order to build my business. But even if I had kept that job, it was not one that would have ever led to any retirement benefits, or anything like that. It would have just been a job that eventually the company went out of business shortly after I quit anyway. Not saying that they went out of business because I quit, but as it would happen, the company went out of business anyway. So, even if I had kept the job, I would have eventually become unemployed. So, I did it on my terms and it worked out perfectly.

So, "don't let the best you have done so far be the standard for the rest of your life". Spread your wings into those other quadrants. Buy a rental property, or some other cash-flow generating investment. And start a business. Something on the side, you don't have to quit your day job. And I recommend it be an online business, because that's where my expertise lies.

I've mentioned before that I had an IT business, a Web Hosting business. Well, let me tell you a little bit about that business. The name is ViUX Systems, Inc, that's V (as in Vision), U-I-X (as in X-Ray). And the website is ViUX.com. And it is a Web Hosting business. What it does is, it helps small businesses and individuals get online and have a website and email, and all the related services that you'd need to do business online. If you've ever heard of GoDaddy, you're aware of what my business does. It's all the same stuff. But whereas GoDaddy has millions of customers, ViUX has thousands of customers.

And when you're seeking to start an online business, I recommend that you begin with the domain name. A lot of companies come up with the name of the business, and then they go out to try to find the domain name, and they end up with a domain name that does not match their business name, or has dashes in it, or it's some extension other than dot COM. And that's not to say the extension has to be dot COM, there are some pretty great extensions that came out a few years ago other than dot COM. But dot COM is still the king, it's still the assumed ending of a domain name.

It means you're going to have to work just that much harder if you don't have a dot COM in order to get it publicly known. So, start with an excellent domain name that matches your business name. Name your business after the domain name once you've acquired it, and try to get one that is an exact match of what you want the name to be, and with the preferably dot com extension. But there are others that you can choose from.

So, with me you'll notice this podcast is the [... and Landlord] Podcast. And I have andLandlord.com. The podcast is brought to you by Blue Chariot Media, and I have BlueChariot.com. I also have BlueChariotMedia.com. The hosting company is ViUX, and I have ViUX.com. Do that favor for your business and get a domain name that matches what you want the business name to be. But before any of that, you have to make up your mind to start a business, to move into the [S] Quadrant. And hopefully you start a business that through additional effort and time in business, and putting policies and procedures in place, that you can move it to the [B] Quadrant.

Regardless of whether you're in the [S] or the [B] Quadrant, the excess income from that business, move it into the [I] Quadrant. Use it to buy investment properties. Buy assets that create cash-flow. So, again, operate in as many of the Cashflow Quadrants as you can. My wife gets her income from the [E] Quadrant, but it makes sense for her to remain there because she has a great job, she gets retirement benefits, and not just that, but she gets the healthcare benefits that our family depends on from her job. I get my income from the [S] Quadrant, and I'm working to move that over to the [B] Quadrant. The money that I make from that business, I save it and I invest it in assets that are in the [I] Quadrant.

So, I have a diversified income structure between my wife and myself. We have three, and working on four legs to our Cashflow Quadrant table, because we're operating in three of the four quadrants. Even if we only had two, we would want them to be on the right side, in the [B] and the [I] Quadrants, because those are the quadrants that will allow us to have other people and systems working for us, rental properties and other investments working for us. Our money working for us, so that the excess cash-flow from those businesses in the [B] Quadrant and those investments in the [I] Quadrant are enough to pay all of our expenses for the lifestyle that we want to life, which is what true financial freedom is all about.

That your business and your investments pay for your lifestyle. That's where we're headed. And so I want you to get there as well, and I want you to start thinking about how you can get into those other quadrants, especially if you're only in the [E] Quadrant right now. And remember, my knowledge of and use of the phrase Cashflow Quadrant in the diagram and everything, it didn't come from me, it came from the book Cashflow Quadrant by Robert Kiyosaki.

From my understanding, it came to him from his Rich Dad, which is from the original book in that series, Rich Dad Poor Dad. I would highly, highly recommend that you go read those books. Start with Rich Dad Poor Dad, and then go to the Cashflow Quadrant book. I think the third in the series, if I'm not mistakes, is one about increasing your financial intelligence. I've also read that, and I'll speak a little bit about that. But read those books. And again, they may not be the best written books, but he will tell you himself, he is not a best writing author, he's a best selling author. So, don't criticize the books for how they're written, or whatever. But utilize them for the content that they contain. The lessons are invaluable, and if you've read them before, as I said, read them again. It has to hit you at the right time in your life when you're looking for that thing that these books can be the answer to that thing you're looking for.

By the fact that you're listening to this podcast, I would suspect you're on a journey leading you towards financial freedom. And if you've gotten this far without reading those books, I'm telling you they were transformational in my life. You should read both of them, starting with Rich Dad Poor Dad, and then go into the Cashflow Quadrant. I'll give you some more information about the other book, about financial intelligence. And there are still more books in the series. But those were the ones that were foundational for me.

And then there's still another book, and that one is The Richest Man In Babylon. Now, Robert Kiyosaki didn't write that book, it's a very old book. I'll give you more details about it. But I will be speaking about that book in a coming podcast episode, because it teaches you how to manage money, and how to save money. And even how to get out of the wrong type of debt, so that you can be successful. And I mentioned the wrong type of debt, because I listen to persons like Dave Ramsey who would teach that you shouldn't have any debt. I personally disagree with that. I think that there are certain debts that you want to have, and certain debts that you don't want to have.

Credit card debt, any other debt that doesn't tie itself to an asset that pays you money is a debt that you want to avoid. But debts like rental property, where the income from the property is paying the debt, there's nothing wrong with that. It's the greatest type of debt you can have. Why wouldn't you want to go out and buy $1 million worth of rental property and have $1 million worth of debt that your tenant pays for? That's the greatest thing ever, why would you not want to do that? That's the best type of debt to ever have.

And so I'll talk more about those types of scenarios as well. All of the books that I mention on the podcast will be available on a books page on the website. I'll upload it at andLandlord.com/books. And you'll be able to click through to get any of the books that I'm speaking of. I'll try to not just put up a list of books and say, "Hey, go read these," but let you know what I took from the book, and how it affected me and my journey towards financial freedom. Because that's what this is all about, it's about using real estate and businesses and other means to achieve financial freedom. And also at the same time, how it should affect your family life.

Like I said, I'm a husband and a father. My businesses and my investments relate to how I am at home with my family. So, it's all about living the best life that you can. I personally think real estate investing and being a business owner is an enhancement to my life. And I simply want to share that with others to give you the opportunity to do the same. And maybe by hearing my story, and those of others I will bring on this podcast, it might streamline your process to get to where you want to be in life.

Exit:

Thank you for listening to the [... and Landlord] Podcast, with me, Jonathan Taylor Smith, by Blue Chariot Media. Following a roadmap to financial freedom through residential, rental, real estate. You can find the podcast website and blog at andLandlord.com. The main company site is BlueChariot.com. If you've received any value from this podcast, help me, please, to make it available to others and make sure you don't miss an episode, by subscribing and posting your five star rating. Plus, share it on social media. I welcome your comments on the blog. And if you'd like to share your Landlord Horror Story, or have a comment or a suggestion for the show, call 844-USA-BLUE - and enter extension 263, which spells "AND" on your keypad (as in AND Landlord). And leave a message. It may be used on a coming show.

Thank you. Be all that you are.... and Landlord.

Disclaimer:

Nothing on the preceding show should be considered specific, personal, or professional advice. Please consult an appropriate tax, legal, real estate, financial, or business professional for personal advice. The comments and opinions of any guest are their own. Information is not guaranteed. Any investment may have potential for both profit and loss. The host is speaking solely on behalf of Blue Chariot Media LLC.

In this episode (#5) of the [... and Landlord] Podcast, I expand on something that I touched on briefly in the prior episode (#4) related to Rich Dad's Cashflow Quadrant, which is a book by Robert T. Kiyosaki. In this book he explains the Cashflow Quadrant (pictured within the above image); and in this episode of the podcast, I relate my own positioning within the Cashflow Quadrant and what you may wish to make your goals for the same, along with how to diversify your income - and why.

I highly recommend that you read this 2nd book in the Rich Dad series (after reading the 1st, Rich Dad Poor Dad) - as together, they are greatly helpful in setting the ideal mindset and providing a guide for financial success. When I first read these books (I've since listened to each 3 times), they were exactly what I needed. They focused my thoughts and efforts on a path that I was previously stumbling to find.

I knew that what I had been taught about finances and investing was somehow "off", but these books made it clear as to exactly what was wrong and what I needed to change. I cannot stress more strongly how valuable these books were for me; and I've found that most Real Estate Investors mention one or both of these books as foundational to their success.

This 5th episode of the [... and Landlord] Podcast begins with a quote...

“Don’t let the best you have done so far be the standard for the rest of your life.” - Gustavus F. Swift

This quote relates because I've been seeking and working towards something more for my life since I became an adult almost 29 years ago upon graduation from high school. I'd been an employee since my first job of age 15 at McDonald's - and I HATED every minute of it! I had been able to get steadily better jobs in food service, retail, offices, tech, etc... But I was still an employee, so they were only slightly less excruciating as the jobs improved.

For more on this, see the Blog post: I HATED Being An Employee! - (From My First Job At Age 15 To Starting My First Business In 1996)

At each step of my employment journey, I was seeking to improve upon this standard to move into something better. And even in 1996 when I started my first business, right through 2002 when I finally ceased being someone else's employee (reaching the level of self-employment) - I was still always seeking to raise my standard for what was to come next.

I established another standard for myself in 2015 when I bought my first rental property, but I did not stop at just one... I'm now beyond double digits - and I want more. To make the quote personal, I refuse to "let the best I have done so far be the standard for the rest of my life" - I can do better! I know that I have it within me to achieve even greater levels of success, ultimately resulting in financial freedom for myself and my family.

In the [... and Landlord] Podcast (Episode #4) - I mentioned some of the things that I had to sacrifice to reach this new standard for my life. In this (the 5th episode), I express this quote and how it relates to the Cashflow Quadrant and my ever changing path (along with my wife) to financial freedom through Employment, Business, Real Estate, and other Investments. Having income from multiple Cashflow Quadrants is essential to growing your wealth and achieving financial freedom.

I express how taxes are the #1 expense faced throughout life for most people, and those who get their income only from the [E] Quadrant are among the most highly taxed. Getting income from the [S] and [B] Quadrants not only provides many tax benefits, but also potentially provides additional funds to buy cash-flow positive assets and investments in the [I] Quadrant. Listen to this Podcast and read or listen to the book Rich Dad's Cashflow Quadrant, to start or focus your path to financial freedom by getting diversified income from multiple Cashflow Quadrants.

![Ep. #2 | The Book & Townhouse That Started My [… and Landlord] Residential Rental Real Estate Investing Journey](https://andlandlord.com/wp-content/uploads/2019/06/Episode-2-YouTube-720p-1024x576.png)